FPT Annual Shareholders Meeting 2010: 2009 dividend is 58.3%

•

30/03/2010

(Hanoi, 27th March 2010) FPT Corporation (stock code: FPT) announced the Resolution of Annual Shareholder Meeting 2010 which approved the payment method of in-cash and in-stock dividend of 25% and 33.3% for existing holders (03 shares for an addition of 01 new share).

Furthermore, in 2010, FPT shareholders shall be prepaid an amount of in-cash dividend of 15% at minimum and bonus share of 25% (04 existing shares after the dividend payment for 01 new share).

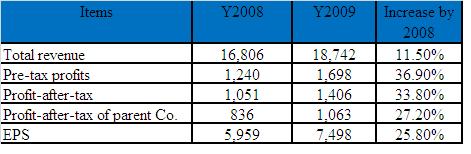

By the end of 2009, the total revenue of FPT grew at 11.5% reaching VND 18,74 2 billion, surpassing 8% as planned. The profit-before-tax was VND 1,698 billion, increasing by 36.9% compared to 2008 and outpaced 12% as planned. The earning-per-share (EPS) reached 7,498 VND, progressing 25.8% so in comparison with 2008 and 18% as planned.

In 2010, FPT continues to pursuit the “e-Citizens” strategy, concentrating intensively on core businesses which are information technology and telecommunication, appealing for synergy among member companies to introduce products and services to the mass consumption market. With these directions, FPT targets at VND 22,996 billion of revenue, increasing by 23% compared to the last year, in which the profit-before-tax is planned to be VND 2,119 billion, adding 25% to that of 2009; to bring the holders the EPS of 8,928 Dongs/share (regardless of stock division).

The FPT Annual Shareholder Meeting approved a number of issues including reports made by the Board of Management, the Board of Directors, and the Supervisory Board, the 2009 financial statement; the issuance of referred share and popular share for FPT employees who have made recognized contribution in 2009.

For press information, contact:

Hanoi

Mai Thị Lan Anh (Ms.)

Department of Communication and Community, FPT Corporation

Tel: 04 73007300

Fax: 04 7689067

HP: 0912081922

Ho Chi Minh City

Nguyen Thanh Nga (Ms.)

Department of Communication and Community, FPT Corporation

Tel: 08 73007300

Fax 08 73007388

HP: 0912413216