FPT Returns to Top 10 Most Valuable Listed Companies After Years

•

22/11/2023

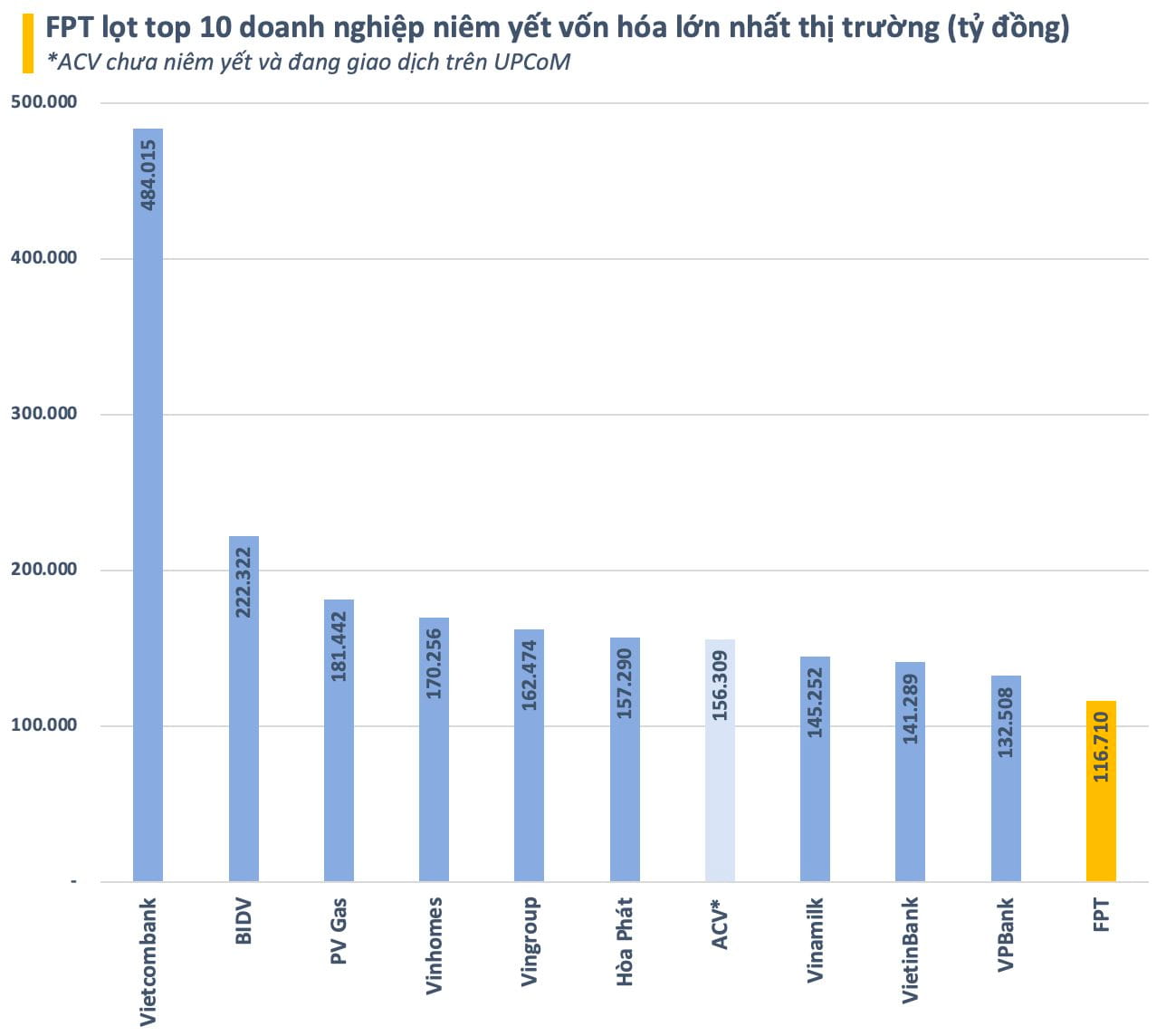

The stock market has recently witnessed a noteworthy shift in ranking the most valuable listed companies. FPT, experiencing a significant surge in its stock value, has propelled its market capitalization to 116.710 trillion VND (~ 4.9 billion USD), surpassing Techcombank (TCB) to claim the 10th position among the largest listed companies in the market.

Considering public companies currently trading on UPCoM, FPT would rank 11th in terms of market capitalization - as the "aviation giant" ACV has been an outstanding UPCoM's representative with a market capitalization of up to 156.309 trillion VND (~ 6.5 billion USD). So, ACV was placed in the 7th position among the largest companies on the entire stock exchange.

FPT ranks in the top 10 listed companies with the largest market capitalization (trillion VND)

*AVC is unlisted and trading on UPCoM

FPT once held the title of the most valuable entity on the stock exchange in 2006. However, the leading technology conglomerate in Vietnam gradually lost its position during the waves of state-owned enterprises and a series of "blockbuster" private companies going public in 2007 - 2008 and 2016 - 2018.

In fact, the figure of 4.9 billion USD is not its highest market capitalization. At its peak in early September 2023, the company's market capitalization reached over 125.700 trillion VND (~ 5.2 billion USD).

Despite the sharp market decline from mid-September, where most large-cap stocks experienced significant discounts, FPT did not decrease too much from its peak. It even quickly recovered. The stock is currently only about 7% lower than its historical peak.

Sustainable Growth on a Solid Fundamental Basis

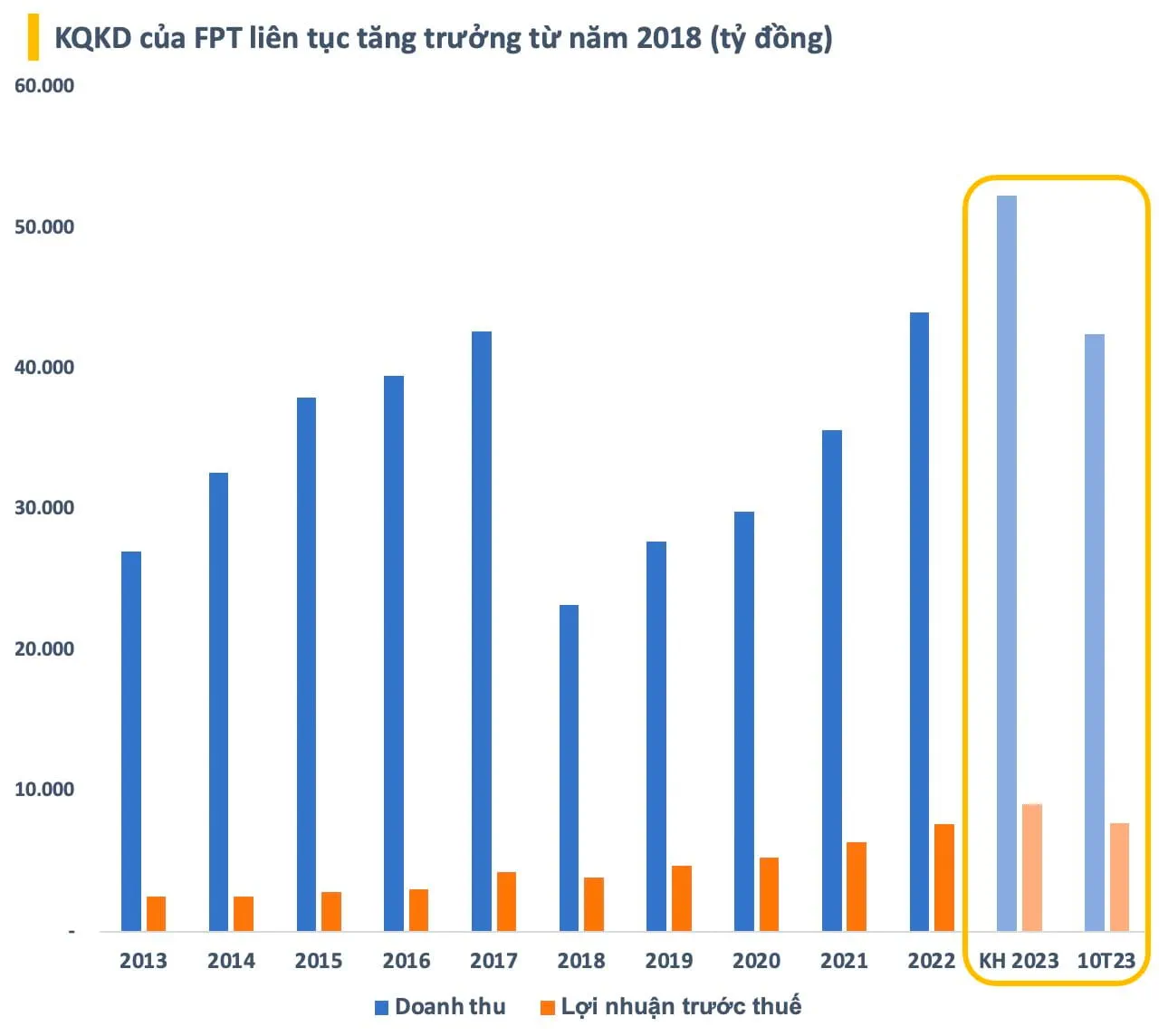

FPT stands out as one of the stocks demonstrating sustainable growth over several years, characterized by a consistent dividend policy. This stability stems from a firm business foundation with sustained high growth rates over an extended period. Since restructuring in 2018, FPT has maintained a strong performance in both revenue and profit each year.

In 2023, FPT aims ambitiously with a revenue target of 52.289 trillion VND (~ 2.1 billion USD) and a pre-tax profit target of 9.055 trillion VND, representing a 19% and 18% increase, respectively, compared to the previous year's actual results. Achieving these targets will enable the Vietnamese tech giant to continue breaking its prior records set in 2022.

FPT's KPI has continuously grown since 2018 (trillion VND) - Revenue - Pre-tax profit

In the first 10 months of 2023, FPT recorded a revenue of 42.465 trillion VND and a pre-tax profit of 7.689 trillion VND, showing growth rates of 21% and 19%, respectively, compared to the same period last year. With these results, it has completed 81% and 85% of its 2023 expected revenue and profit.

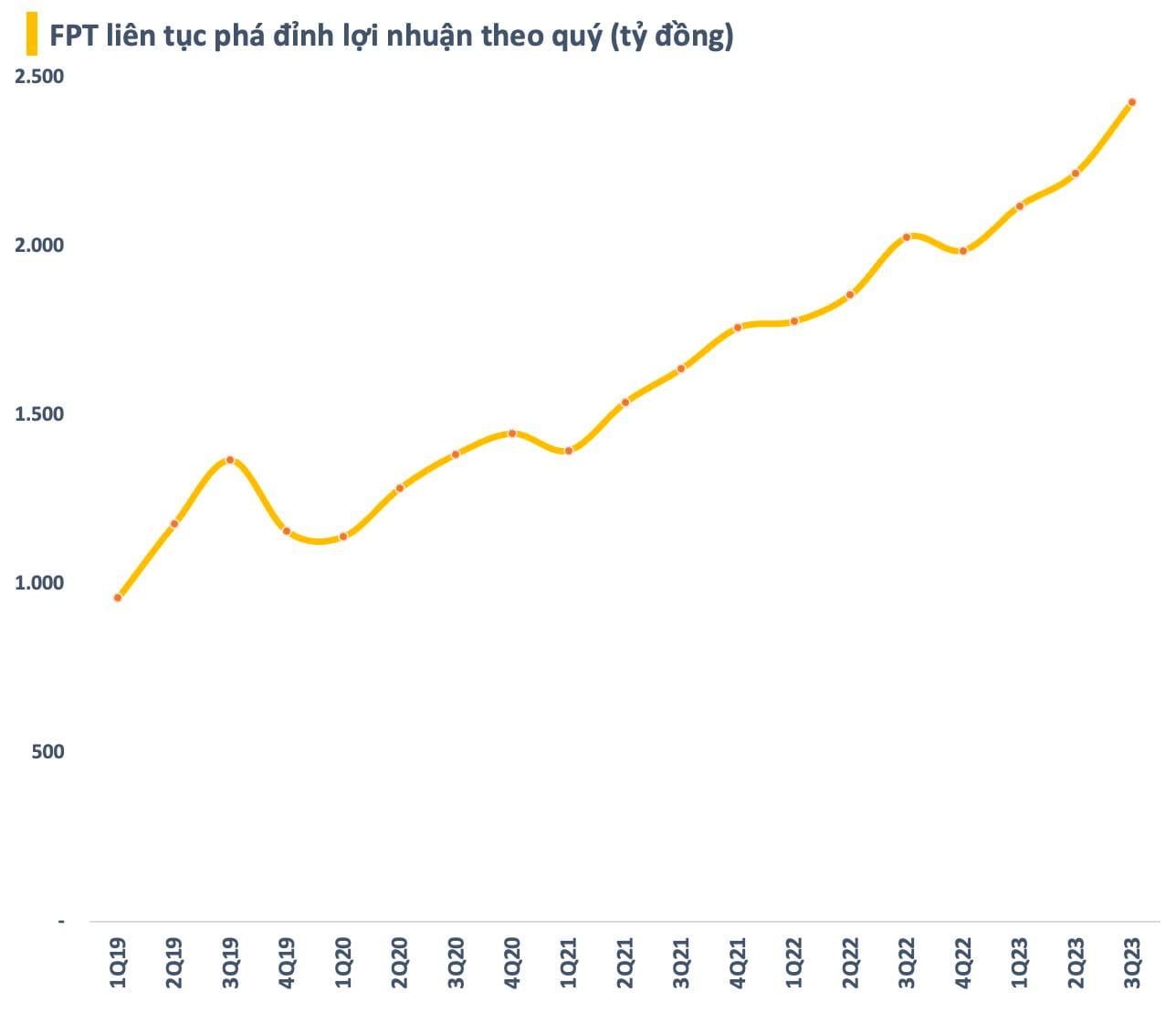

Before this, FPT continued to break profit records, with a pre-tax profit in the third quarter exceeding 2.400 trillion VND, a 20% increase compared to last year. This result extends its profit streak by quarter compared to the same period. FPT is among a few entities that have maintained this accomplishment for many years.

FPT continued to break profit records by quarter (billion VND)

Is the Valuation Still Engaging?

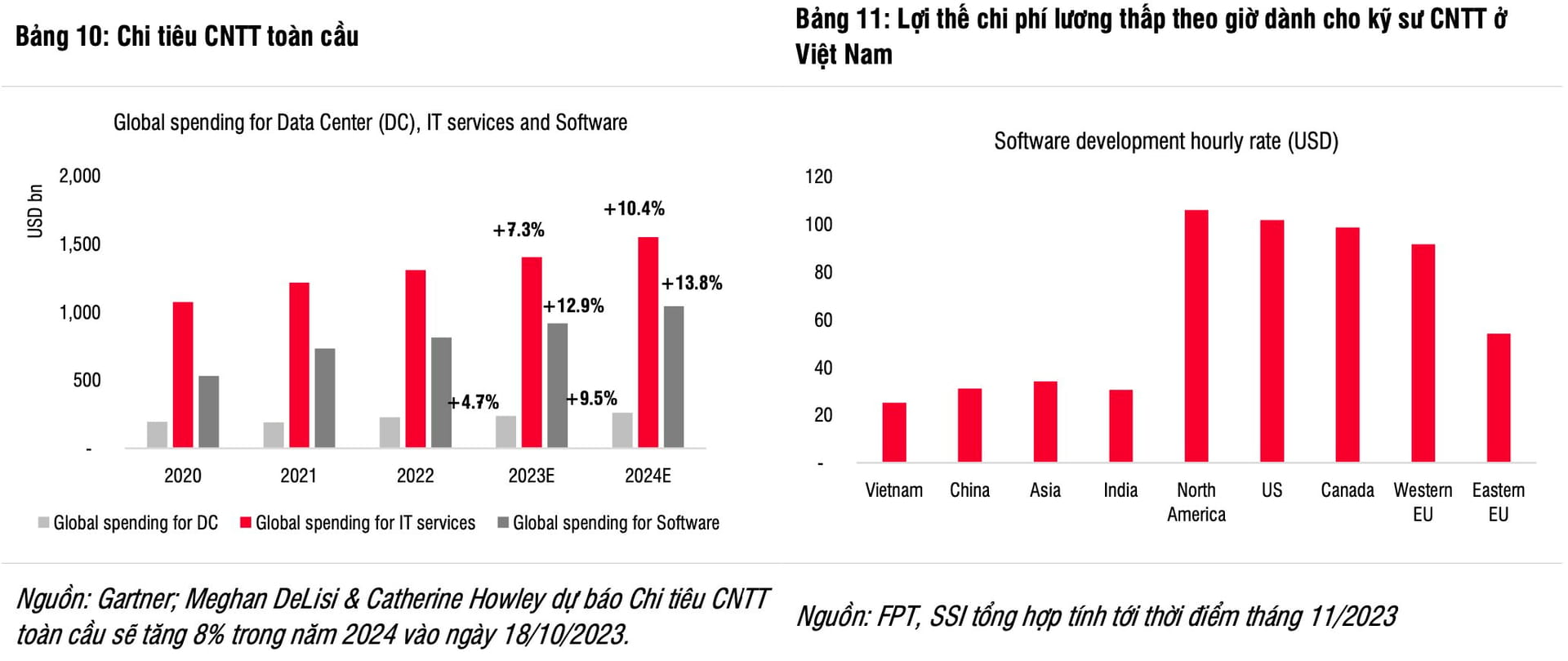

In a recent report, SSI Research expects FPT to secure more contracts due to its low-cost advantage and long-term benefits from increasing recognition in the international market. The analysis department projects that the foreign IT segment's net profit will grow in double digits in 2024 (increasing by 26% YoY), lower than in 2023 due to a slowdown in new contract value in the first nine months of 2023.

However, SSI Research also anticipates that the slowdown in IT spending in 2023 will drive more growth in 2024. According to Gartner, global IT spending is expected to increase by 8% in 2024, with growth rates for Data Centers, IT services, and Software being 9.5%, 10.4%, and 13.8%, respectively (compared to 4.7%, 7.3%, and 12.9% in 2023).

Source: Gartner; Meghan DeLisi & Catherine Howley projects that global IT spending will increase by 8% in 2024 (dated October 18, 2023) & Summarized by FPT and SSI (as of November 2023)

Regarding the domestic IT and online advertising segments, SSI's analysis department expresses cautious views as there is no certainty about the stable recovery of the Vietnamese economy in 2024. Domestic IT is forecasted to remain flat, and online advertising is predicted to grow by 3% YoY from a low base in 2023.

Furthermore, FPT's education sector is also anticipated to maintain a solid growth trend in 2024 due to the imbalance between supply and demand for education in the country and the expectation that FPT University will admit the first batch of students in the Semiconductor field. In addition, the exchange rate risk related to FPT's foreign debt is insignificant due to the high loan interest payment ratio and high net cash level.

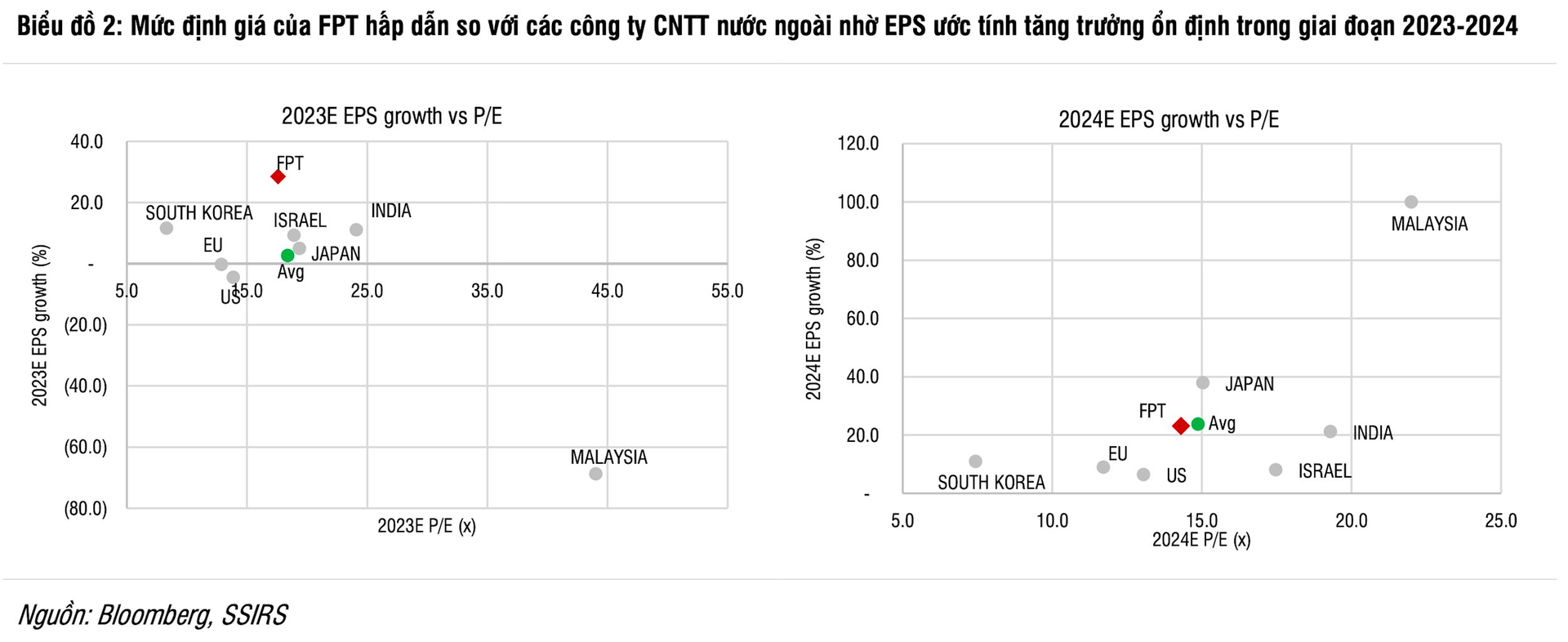

Overall, SSI Research projects that FPT's pre-tax profits will grow by 19% and 21% in 2023 and 2024, respectively. Due to the stable estimated EPS growth in the 2023-2024 period, FPT's valuation is considered attractive compared to foreign IT companies, although its stock is still close to its historical peak.

FPT's valuation is attractive compared to foreign IT companies due to stable EPS growth in the 2023-2024 period

Source: Bloomberg, SSIRS